3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

Compared with donating cash, or selling your appreciated securities and contributing the after-tax proceeds, donating appreciated securities is a very tax-efficient means of gifting. You avoid paying capital gains tax on the profit of those securities and you can take a tax deduction for the full fair market value of your donation (subject to limitations).

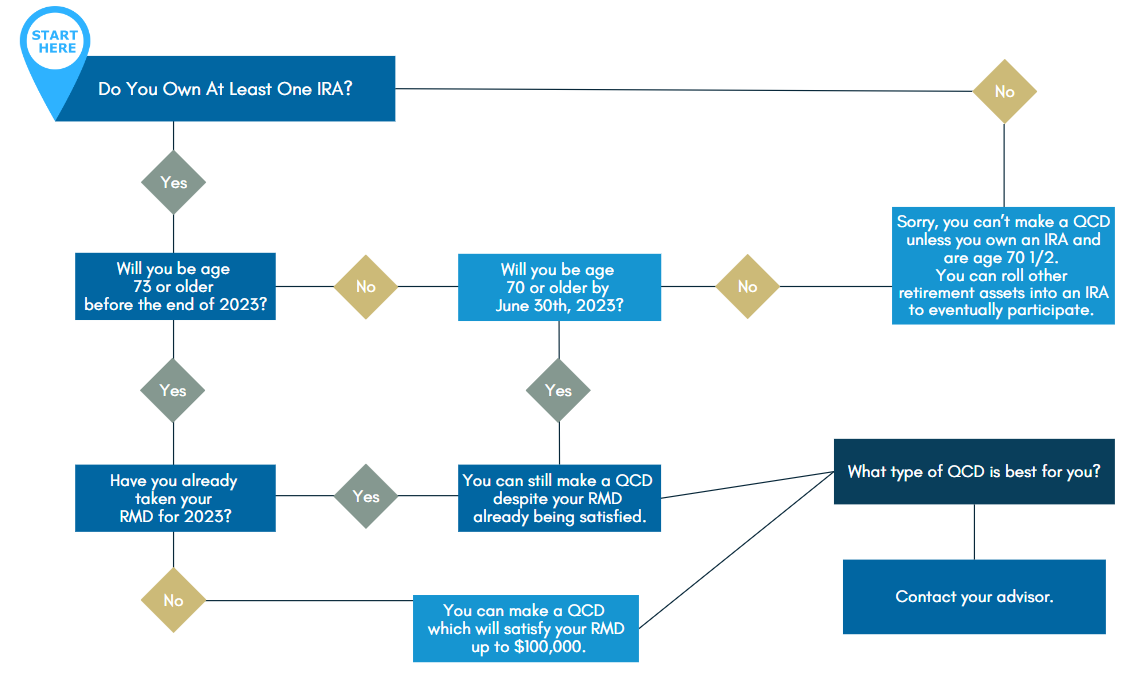

Qualified Charitable Distributions (“QCDs”) are distributions made from an Individual Retirement Account (“IRA”) directly to a qualified charity. QCDs are permitted for individuals age 70½ and older up to $100,000 in the calendar year 2023.

When processing a QCD, the corresponding 1099 from your custodian will NOT list the distribution as a charitable contribution, thus it is incumbent upon you to notify your CPA that the distribution was a QCD. Note, QCDs cannot be made to a Donor-Advised Fund.

A Donor-Advised Fund (“DAF”) is a charitable giving account that is set up with your custodian to manage your charitable donations. You receive an immediate tax deduction when making a charitable donation to the DAF and you direct the custodian when to disburse funds (grants) to the qualified charities of your choice.

This strategy works well when an individual has appreciated securities (stocks or mutual funds) that he or she has owned for at least a year and would now like to donate. Once donated to the DAF, the assets can remain there until you provide further instructions on when the funds are to be disbursed to your charity of choice. This is particularly useful when an individual has higher-than-usual income, such as from the sale of a business or a large bonus. The individual can front-load several years’ worth of charitable gifting in one year (DAF gift) to receive a larger tax deduction that particular year. Then, the individual can direct smaller amounts be made from the DAF (grants) to qualified charities over the ensuing years.

Ask Your Wealth Manager or CPA if you are looking for ways to make a difference and minimize your tax obligation before year-end.

DISCLOSURE: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Beaird Harris Wealth Management, LLC -“Beaird Harris”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Beaird Harris. Please remember that if you are a Beaird Harris client, it remains your responsibility to advise Beaird Harris, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Beaird Harris’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: Beaird Harris does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Beaird Harris web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

CHART: Due to various factors, including changing market conditions and/or applicable laws, the illustration may no longer be reflective of current opinions or positions. Moreover, you should not assume that any information contained in this illustration serves as the receipt of, or as a substitute for, personalized investment or tax planning advice from Beaird Harris Wealth Management, LLC To the extent that a reader has any questions regarding the applicability of any specific issue illustrated above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Beaird Harris Wealth Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the illustration should be construed as legal or accounting advice. A copy of the Beaird Harris Wealth Management, LLC’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to…

Beaird Harris is pleased to welcome three new partners: Nathan Biggs, Matt Edrington and Matt Skinner, to its public accounting practice, signifying the Firm’s continued…

Beaird Harris Named to Dallas Business Journal’s 2024 List of “Top 100 Money Managers.”

We’ll help you get started and learn more about Beaird Harris.